Many options traders have difficulties in determining when exactly to pull the trigger and enter into a new trade. Luckily, technical indicator tools are available to help demystify the process and these tools can often be quickly interpreted and placed on your trading platform. To start, we must have an understanding of the various indicator types and the signals they are sending with respect to price activity in the markets.

Once we understand these factors, we can use this information to increase the probability of accurate forecasting for options trades. First, we will look at each major type of indicator to see how these tools operate.

Indicators are an essential part of any good binary options trader’s toolbox. By using indicators effectively, you will be giving yourself a large advantage over people who trade based solely upon the feel of an underlying asset. While these traders might be right, sometimes even more than 50 percent of the time, they are not using one of the best and most effective tools that currently exist for traders.

There are indicators that exist for all types of traders, and binary options trading is no different. In fact, the best part about binary options trading is that indicators are often more effective when it comes to making a profit. This is because with binary options, you don’t need to have a large price increase or decrease. Instead, you only need to be right by a miniscule amount in order to get the full return.

Binary Trading Indicators

A good, long term, indicator strategy will look for signals that a price trend is going to continue. If you are trading the longer termed binary options, you definitely want an indicator that will tell you when a trend is most likely to continue, but if you are looking at shorter termed options, such as the 60 second binary option that many sites now offer, this doesn’t necessarily need to be the case. You can look at indicators that might point to price reversals here. In fact, this will give you an extra advantage because you will be able to trade both up and down without increasing your risk.

Some traders look to take contrarian approaches to trading but the majority of investors look at the wider trends in the market and then trade in the direction of those trends. To determine the direction of these trends (and then place binary options trades accordingly), we can look at trend following indicators to determine whether we should be looking to buy CALLS or PUTS.

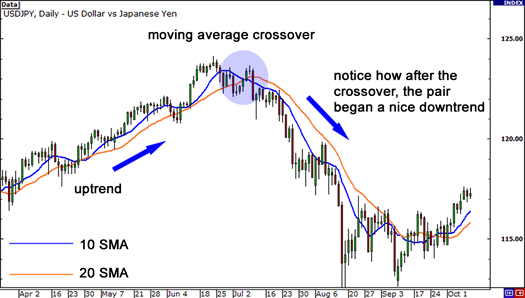

One of the most popular indicators in this category is the Moving Average, which marks the average closing price of a set number of time periods. Common settings for this indicator include 10, 21, 55, 100 and 200 time periods. Traders use these Moving Averages (MAs) in concert with one another to find “crossovers” between a shorter term MA and a longer term MA. You can trade the crossovers at 24option.

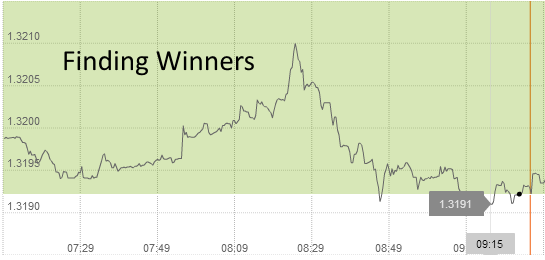

In a downside crossover, a bearish trend is expected, and this creates an opportunity for PUT options. In an upside crossover, a bullish trend is expected and this creates an opportunity for CALL options. In the chart below, we can see a downside MA crossover following an uptrend. This would have been an excellent opportunity for PUT options:

While an indicator like a MA combination can give traders an idea of a developing trend, trend confirmation indicators can be used to “confirm” trends that have already been established. These indicators can help to show if trend momentum is healthy and likely to continue (or reverse).

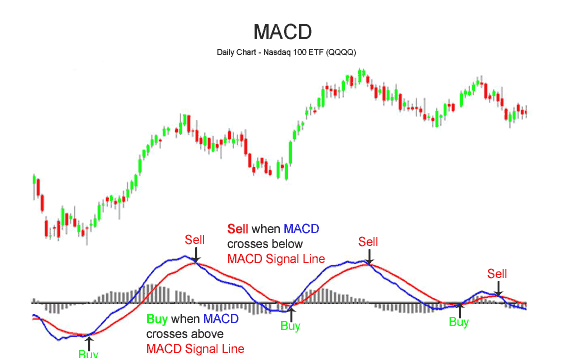

One of the most popular tools in this category is the Moving Average Convergence Divergence (or the MACD), which measures the difference between two moving averages and is plotted against a histogram to help forecast price direction. In the chart below, we can see how buy and sell signals (for CALLS and PUTS) are generated with the MACD:

The MACD indicator can be used in conjunction with other indicators as well. For example, if we can see a buy signal in the MACD at the same time a bullish MA crossover is seen, an excellent opportunity for CALL options would be developing. Agreeing indicator signals will generally lead to higher probability trading opportunities.

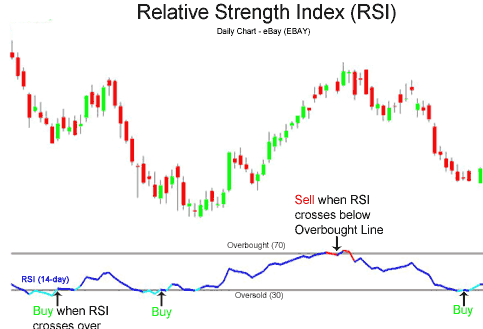

Another technical indicator strategy can be seen with the overbought and oversold indicator tools. These tools give traders an indication of when prices have risen too high (become overbought) or become too cheap (and are now oversold). Overbought conditions present opportunities to enter into PUT options (on the expectation of later price declines) while Oversold conditions present opportunities to enter into CALL options (as prices are then expected to rise).

One of the most commonly used tools in this category is the Relative Strength Index (RSI). Basic economics tells us that when asset prices become too expensive, people are less likely to buy that item and more likely to sell it. This situation represents an overbought condition and PUT options become preferable. Conversely, when asset prices become too cheap, people are going to look to buy this item (as it is now oversold) and this is a bullish scenario for the asset. In these cases, CALL options are preferable.

Using the RSI, indicator readings below 30 suggest oversold conditions while readings above 70 suggest an asset is overbought. In the graphic below, we can see how the indicator displays sell signals that can be used in options trading:

There is another choice when it comes to indicators, as well. Buying an indicator service’s assistance can be of great help here. These services often have great track records when it comes to correctly predicting the movement of a specific market, and while they aren’t exactly made for binary options trading yet, you can usually get a good feel of where the market is headed by reading their commentary. Again, these services don’t need to tell you that Asset XYZ is going to jump up $25 in price; they only need to be correct by a minute amount in order for you to get the full benefits of binary options trading. The small price you pay for a monthly subscription can easily be offset by your profits if you get on with a good and reputable service. Of course, there are some services out there that you should not waste your time with, as well, so make sure you do thorough research in this area.

Indicators can make you a great trader, but where do you start? First, look at past data for the assets you will be trading. What are the similarities that they experienced when going through certain trends? What similar factors contributed to a price reversal? Even if you are trading within trends, you still need to know the warning signs of reversals so you can know not to trade in these instances. Trading is a two way street, and you won’t be right all the time, but with a good amount of study, you can begin to inch your way over that random chance line of 50 percent and start turning a profit.Binary options are perhaps the easiest type of trading to do because you don’t need to be right by as much. You still need to look for only the strongest of indicators, however. These will increase your correct trade rate and thus enhance your bottom line. Trading is all about making money, and sometimes making money is very difficult. Go with only the best indicators you can find and you will soon see that your correct trade rate is moving in an even more profitable direction.

Triple Bollinger Bands Strategy

This binary options strategy can be used to increase prediction accuracy when trading price reversals. Oftentimes, this method will help you to determine an upcoming reversal well before any change in market sentiment has even taken place. Japanese candlesticks will be employed to establish the future price direction. Stochastic and Bollinger Bands will also be used. These will supply the signal to enter into a trade. Novice traders can use this strategy, but some familiarity with these indicators is necessary, as is some familiarity with charting tools such as MetaTrader4.

The first step is to locate the point where the top tip of the secondary candlestick is below the top tip of the first candlestick. This will be the action for day one. Next, look for the lowest point of the secondary candlestick to be above the lowest point of the candlestick for day one. Once the stochastic indicator is displaying over-buying in the market and the intraday candle is positioned at the very top Bollinger band, a reduction in price is being suggested. When reversed, this method will suggest a forthcoming rise in price.

This binary options strategy may appear complicated on paper, but within your chosen technical analysis chart you should be able to easily observe these actions occurring. When looking at your chart, the correct time to enter the market is going to be very obvious. Nevertheless, this strategy will not be exceptionally valuable unless the specific price movement is combined with the proper type of instrument. Standard Call or Put trades are usually the best instrument to use with this strategy. However, they’re not the only instrument option.

For standard Call/Put trades, anytime the intraday candle shows up at the lowest Bollinger band and the stochastic is display over-selling in the market, get ready to trade. When this setup occurs, opt for a “Call” option and select an expiry time of of 2-3 days. When using this strategy along with a No-Touch trade, make sure that the entry price is approximately 50 pips under the present selling price and is already moving towards the target price. Again, any expiry of 2-3 days is the recommended selection.

The strategy for One Touch trades is a bit different. With this type of instrument the entry price needs to be selected from inside the selection of prices that stretch from the center Bollinger band to the present selling price. With this type of trade, the expiry needs to be a minimum of four days to provide sufficient time for the price to reach or exceed the target. Within the majority of binary options trading platforms, the One Touch instrument typically expires within 5-7 days. These expiry times are perfectly suitable for use with this strategy.

When Bollinger Bands are used along with the Stochastic oscillator, the occurrence of false signals will be reduced. However, this does not mean that errors cannot occur when utilizing this binary options strategy, especially in the event that the expiry time finishes close to the discharge of any connected economic or earnings report. Make sure that you look at your economic calendar in advance of choosing the expiry time. The only exception to this rule will be One Touch trades, because significant market reports could supply a powerful price thrust that could enable the asset price to reach the target price