Binary Options Robot is an automated signal trading software designed to make signals for you automatically, regardless of whether you are at your computer, signed into an account, or relaxing on the beach. Binary Options Robot finds the trades that fit the criteria you have helped it to establish, and then generates signals for you based upon an advanced signals detection algorithm. So far, this has proved to be the most successful binary option robot out there, and a lot of people want to learn more about it and how it might be able to help them. Our brief Binary Options Robot review is designed to do just that.

Binary Options Robot

Binary Options Robot Really Free?

Let’s tackle the big question that most people have right away. Binary Options Robot is free to create an account with. Right away, this separates it from many other auto trading software and signals services. There is no cost to create an account with this robot. You will even be able to test a $10,000 demo account that was provided to you upon signup. After you have tested their automated signal trading app with a demo account, you can make a deposit of minimum $10 and start with automated signal trading for real money.

It is very easy to sign up with Binary Options Robot. All you need to do is fill in the registration form on BinaryOptionsRobot.com website, verify your email and you are good to go.

How Does Binary Options Robot Work?

The Binary Options Robot is not a broker. Rather, after creating an account, you will be assigned to a broker where the robot will generate signals for you. If you already have an account with a broker, you can still use that same broker with the Binary Options Robot. Just click on the Login button and log in using your account credentials.

All monetary transactions are done with a safe and secure broker, for example binary.com broker or Deriv.com. Trading signals are generated with the binary options robot, and you can do all your fine tuning here. But they do need you to choose a broker to work with in order to accept signals and place trades.

Once you have selected a broker, your next step is to decide how much risk you want to take on. Your risk level has a lot to do with how profitable you will be. The robot itself has a great track record, but this doesn’t mean that it is perfect. It also doesn’t mean that this track record will be consistent moving into the future. Past results are not indicative of future results. The more risk you take, the higher your potential for profits, but also the higher your potential for losing money.

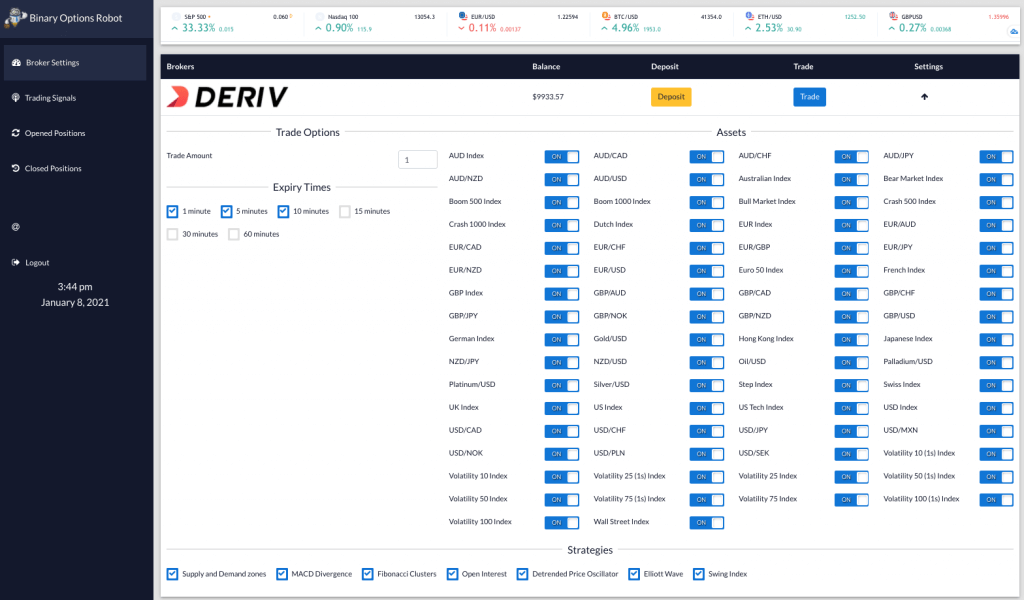

You can also filter what you trade. If you want to trade just the euro/usd pair, you can adjust the settings so that only this asset will be focused on. You can adjust all of this as you go and become more familiar and comfortable with what you’re doing. Binary Options Robot settings, like trading assets, trading strategies, expiry times and trade amount are configurable on a very user friendly dashboard that can be accessed in the Broker Settings tab.

Expiry Times – Traders can define whether they prefer shorter expiry times, such as 60 second trading, or trading that lasts longer and after 1 hour.

The following expiry times are available:

- 1 minute

- 5 minutes

- 10 minutes

- 15 minutes

- 30 minutes

- 60 minutes

Depending on the selection of expiry times, trading assets and trading strategies, Binary Options Robot signals will be generated and displayed to the trader under the Trading Signals tab.

To create an account with the Binary Options Robot, you simply open up their site, click the “Get started now” button, and follow the prompts, providing your information where needed. Please note that not all countries are allowed to use robots.

Binary Options Robot Trading Assets

There are over 60 trading assets available to trade with Binary Options Robot. Available currencies, commodities and indexes are displayed below. Depending on the trader’s preferences, signals for selected trading assets will be generated within the Trading Signals section.

Traders can choose from the following trading assets:

- AUD Index

- AUD/CAD

- AUD/CHF

- AUD/JPY

- AUD/NZD

- AUD/USD

- Australian Index

- Bear Market Index

- Boom 500 Index

- Boom 1000 Index

- Bull Market Index

- Crash 500 Index

- Crash 1000 Index

- Dutch Index

- EUR Index

- EUR/AUD

- EUR/CAD

- EUR/CHF

- EUR/GBP

- EUR/JPY

- EUR/NZD

- EUR/USD

- Euro 50 Index

- French Index

- GBP Index

- GBP/AUD

- GBP/CAD

- GBP/CHF

- GBP/JPY

- GBP/NOK

- GBP/NZD

- GBP/USD

- German Index

- Gold/USD

- Hong Kong Index

- Japanese IndexNZD/JPY

- NZD/USD

- Oil/USD

- Palladium/USD

- Platinum/USD

- Silver/USD

- Step Index

- Swiss Index

- UK Index

- US Index

- US Tech Index

- USD Index

- USD/CAD

- USD/CHF

- USD/JPY

- USD/MXN

- USD/NOK

- USD/PLN

- USD/SEK

- Volatility 10 (1s) Index

- Volatility 10 Index

- Volatility 25 (1s) Index

- Volatility 25 Index

- Volatility 50 (1s) Index

- Volatility 50 Index

- Volatility 75 (1s) Index

- Volatility 75 Index

- Volatility 100 (1s) Index

- Volatility 100 Index

- Wall Street Index

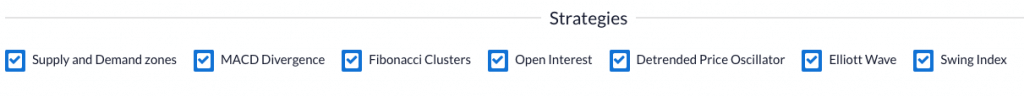

Binary Options Robot Trading Strategies

Traders can choose between seven Binary Options Robot trading strategies. Each of these strategies involves implementing different trading algorithms to generate trading signals.

Traders can select all strategies that are explained below, or just a few strategies that fit to their trading plans the most.

- Supply and Demand zones – These are the zones where the price is most likely to rise or fall.

- MACD Divergence – Divergence is a tool that can be used to spot potential market reversals by comparing MACD with market direction.

- Fibonacci Clusters – A trading method that utilizes a grouping of Fibonacci retracements and expansion levels that occurs in close proximity to each other on a price chart.

- Open Interest – Open Interest is a helpful tool in analyzing the strength or weakness of a price move.

- Detrended Price Oscillator – The oscillator shows overbought or oversold levels which can be used to give buy and sell signals.

- Elliott Wave – Elliott Wave is based on a crowd psychology of booms and busts, rallies and retracements.

- Swing Index – This strategy predicts future short-term price action.

Binary Options Robot Trading Signals

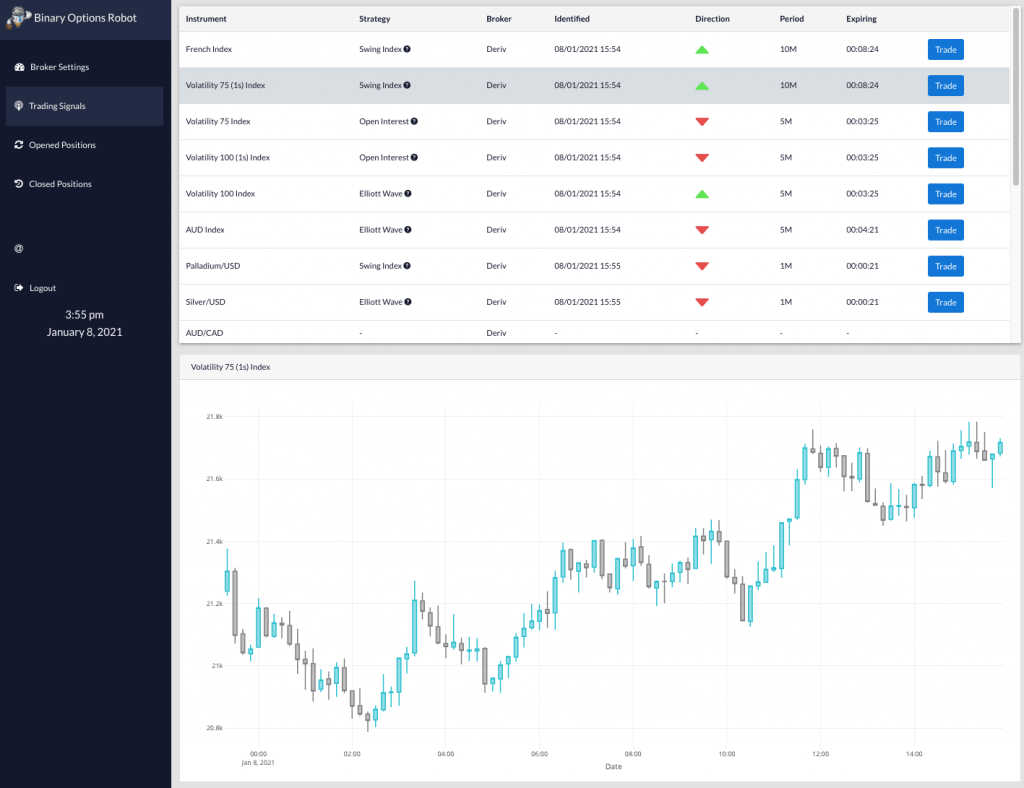

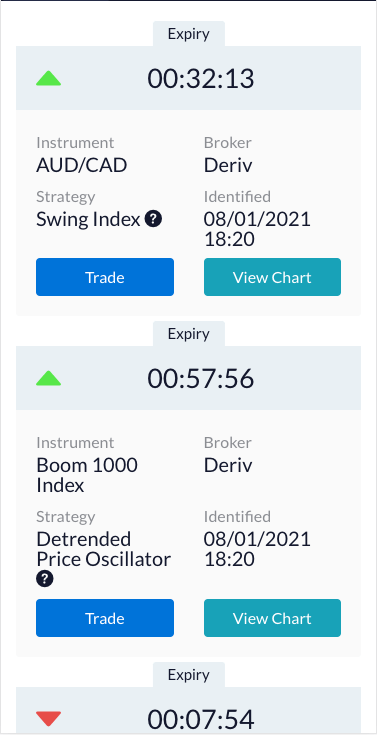

Binary Options Robot trading signals are generated depending on the trader’s selection of trading assets and strategies.

Trading signals are generated automatically and the trader has a full overview of the signals in the Trading Signals tab.

Traders can place a trade with the use of Binary Options Robot trading signals with a single click on the Trade button.

Once clicked, trading signal prompt will appear and with a single click, the trader can confirm the signal and place a trade.

Before confirming the signal, traders will have a full overview of the trade that they are about to place. This includes information about the trading strategy that was used to generate the signal, selected asset and expiry time. You will also have information about the broker where the trade will take place, as well as information about the time when the trading signal was identified by trading algorithm.

A full overview of all open positions is available under the Opened Positions tab and closed positions can be accessed within the Closed Positions tab. Thanks to this, traders can have a full overview of their profits per each trade.

Binary Options Robot Mobile

Binary Options Robot mobile signal service is completely free, and traders will be happy to know that it has the entire Binary Options Robot dashboard in the palm of their hands.

From now on, traders can easily customise their trading settings, make a deposit and benefit from automated trading signals simply by using their iPhone or Android mobile phone.

With Binary Options Robot mobile trading is better than ever and important features that traders find relevant on the desktop platform are also present on the mobile version.

With a single click, traders can get access to the trading chart and accept trading signals.

Who Benefits from Binary Options Robot?

Because of its simplicity, a lot of beginners are attracted to the Binary Options Robot. You never need to understand signals, how to interpret them, or even really what they show to use the binary option robot with success. These things can be helpful, but they are not required. To use this signals robot, all you need to do is make a deposit (discussed above), and select the assets and strategies that you want to trade. Beginners will likely benefit from taking trades on deriv demo account first, until they have established more experience with the product and are ready to make a deposit. This is a situation that needs to be addressed by each trader individually.

New traders can certainly benefit a lot from this signals service because of the fact that no technical skills are needed to use it successfully. Binary Options Robot trading room is very user friendly and easy to use. Once you log in, you get a full overview of all the available signals and you can easily place a trade with a single click.

However, they are not the only ones that benefit from the Binary Options Robot. Even a professional trader can benefit from this because it helps to save time and diversify risk. Let’s say that you have $50,000 in a binary options tradingaccount, and you spend eight hours a day in front of your computer analyzing trades.

If you put $1,000 into a Binary Options Robot account and let the software generate signals and you just make trades with a single click, you stand the potential to use your time in the same way and start making more money, or you might find that you can spend less time working and still make the same amount. Binary Options Robot can be a great tool to practice 60 second binary options strategy. Experienced traders benefit by being given this ability to take some of the burden of risk away from themselves and use their time more efficiently at the same time.

Should I Use Binary Options Robot?

This is up to you. We’ve given you the basic information that you need to get started, but the decision of whether or not this is the right tool for you to effectively grow your own cash is ultimately up to you.

If you still have questions about the Binary Options Robot, we encourage you to check out their website and learn more. They do have a lot to offer traders that work with them, but this certainly is not right for everyone. And remember, just because the robot is generating signals for you does not mean that these are risk free trades. There’s still a chance to lose money when you use Binary Options Robot. If you decide this is right for you, keep an eye on your account so that you can watch over it and make sure that your money is doing what you want it to.

This Binary Options Robot review shows that it has a lot of potential to help traders of all abilities. If you are in an area where it is allowable for you to use this automated signal trading app, and you want to try this efficient new way of trading, then we highly recommend Binary Options Robot.

Binary Option Auto Trading

You might have heard in the news how robots are taking over most of the human jobs. While it may be sad for many people who may lose their jobs, there is great news for professional traders that modern binary option robot is equipped with amazing skills to mimic real-life trading. A trading robot is simply a computer program that makes prompt decisions regarding whether to buy, sell, or retain a respective financial asset, when given particular trading signals and trading parameters.

Trading with these robots may be better in various ways. For example, human traders no longer have to be actively present in front of their PCs for long hours, and get involved in complicated data analysis on a regular basis. Moreover, humans are likely to make errors due to psychological and emotional factors. On the other hand, these errors can be completely eliminated by best trading robots.

Trading robots are especially helpful when it comes to trading forex and binary options (for any assets). However, there has been some misconception about binary option robot. Some people consider them a scam or see trading robots as too good to be true. As a trader, what you need to understand is that a trading robot is not a miraculous invention that exploits the market in unprecedented ways. Instead, a binary option robot is merely a tool, like thousands of other tools designed by humans.

Similarly, a trading robot is not going to provide 100% accuracy, and its performance is very much dependent upon the parameters you feed into its system. In other words, it is still humans that make decisions on the back-end. A trading robot makes life easier by performing operational tasks automatically.

As the use of a trading robot is a relatively new phenomenon, many traders are not fully aware of the trading robots available in the market. It is important to exercise due care when purchasing a trading robot, as all robots are not the same in performance, accuracy, and efficiency.

While there are hundreds of trading robots that claim to provide different amazing services, this article tries to provide a brief analysis and discussion regarding some of the trading robots.

The purpose is to improve readers’ knowledge and understanding about binary option robot, and to help them identify some of the best auto trading software available in the market at present.

Automated Binary Options Trading

While auto trading software or another automated trading service is designed to save you time, that doesn’t mean that you should not invest any effort into it researching binary option robot more. Auto trading software or option robot is not for those without experience, but rather for those traders that know exactly what they are looking for and are using the option robot as a tool to save time or to supplement profits.

For example, if you look at your robot and it allows you to control how much risk you take on per day, which assets you want to focus on, and other aspects of your trading, you have found one that allows for a high degree of customisation.

Customisation is important because automated binary options trading tend to operate on algorithms. When an asset shows a certain pattern, then a trade is made. This is usually fine, but as any experienced trader will tell you, when conditions exist where this is a bad idea, you can lose a lot of money. Being able to customise your trades will help you to smooth these bumps out.

Below, we’ve listed some of the best binary options robots and given a brief description of their pros and cons. This should get you started in finding the best binary signals to meet your needs as a trader. A binary alert service often covers several types of assets, so these can be helpful for short term Forex and stock traders, too, in many cases. It’s all up to how you trade, so have a firm grasp on what you are doing before you sign up for anything. Many people do use these services to help learn how to trade as well, making a service a great tool for a beginner.

Best Binary Option Robot

An auto trading software (also known as a binary options robots) is a computer program that has a sophisticated algorithm behind it. Using the algorithm, the traders are able to define trading rules; for example, to sell currency as soon as its value is reduced by 10 %. These auto trading software are becoming more and more popular, and it has been estimated that at least 2/3 of the shares traded in the United States stock markets are with automated trading robot. If you are US trader, most of the binary options robots will not be available to you, as explained in Nadex auto trading article. Let’s understand some benefits of using such auto trading system.

- Trades are conducted based on the rational rules provided by the traders; hence, eliminating the involvement of emotions and psychological factors.

- It may be easier to exploit time-sensitive opportunities with the help of automated trading software, as it is impossible for a trader to be available 24 hours for trades execution.

- These automated trading software programs also provide the option of back-testing trading strategies. So, it becomes possible to test your idea or strategy on previous data to determine its feasibility and workability before executing it in the real market.

- With the help of these programs, it becomes possible for a trader to execute multiple trading strategies at any given time; hence, allowing the ability to diversify investments.

- Last but definitely not the least, automated trading software minimizes the need for constant data analysis at the trader’s end.

Automated trading software provides some amazing benefits for traders. However, since it is just a tool created by humans, it is not free from its shortcomings. Let’s look into it:

- It is true that automating the trading system provides peace of mind to traders. However, it may not be entirely true as traders are still expected to monitor the system even now and then to ensure the smooth functioning of the system since there is always a danger of hardware or trading software malfunction.

- Creating the right trading strategy (trading parameters against which trades are to be executed by robots) may not be a straightforward task. In fact, it is usually a matter of trial and error until a sound strategy is found.

- Choosing the right automated trading software requires considerable time and effort, as all trading software programs are not the same in their performance and financial results. So, there is always a danger of wasting money on ineffective auto trading software.

If you prefer manual trading over automated trading don’t worry, there are several brokers available and we provided a full broker overview in Olymp Trade review and Expert Option review.

Best Binary Robot 2021

Binary options trading robots, much like other signals services, have certain things that you need to look out for. Some of these include:

- How long has the auto trading robot been operating?

- How profitable has this binary option robot been?

- Is this auto trading robot well regarded by other traders?

- Is this robot legitimate?

- How can this binary robot be customised?

This last point is an important one in determining what is the best binary robot. Some automated signal trading apps like Binary Options Robot let you have a large degree of control over what trades are made and some services give you no control. If you are from USA you cannot trade with the bots that currently is available in the market. However you can follow the guidelines written in our Nadex review.

Binary Robot

Various aspects related to automated trading software and binary robots are discussed in earlier sections. While we are going to provide brief reviews of some of the popular binary options robots in the next sections, it is important to set some ground rules here. You need to have certain parameters in mind when trying to analyze various available options related to binary robots.

Let’s look at some fundamental features that define the efficiency and effectiveness of an automatic binary trading robot:

- Brokers: A simple google search of “binary robots” will yield hundreds of different results related to various firms offering these services. In order to avoid wasting your time, efforts, and money, make sure to only shortlist those binary robots which are not offered by brokerage firms. Affiliation with a broker could be a potential red flag (even though that is not always the case).

- Minimum Initial Deposit: Regardless of whether you are a beginner or a seasoned trader, you do not want to risk a big sum of money when trying a new auto trading robot. Deposits are usually made directly with the binary options brokers that are connected to the robot. Hence, gather information related to the minimum deposit requirements. The lower the requirement, the better the automated trading platform may be (because of the low risk involved).

- Demo Account: Similarly, you do not want to risk your money straightaway without testing the waters first. It may be the case that binary trading is new for you, or maybe you do not feel confident with auto trading at a new platform. In either case, you deserve a free trial run. A good service provider will always provide a free demo account in order to allow yourself the opportunity to try out the platform and various trading strategies, before executing them in real market conditions.

- Reliable deposit/ withdrawal methods: A good service provider will provide a range of various funds deposit and funds withdrawal options, which may range from debit/credit card to wire transfer and e-wallets among various other options.

- Flexible Automation Option: You don’t want your platform to run on its own all the time. At the same time, there is no point in having an automated trading robot if it requires your assistance on a regular basis. Ideally, you should be able to customize the level of your daily involvement in the platform. Service providers that do not allow such customization may not be suitable for you.

Free Binary Option Robot

Binary Options Robot offers a unique automated signal trading app to its traders. Binary options traders can experience many features of this advanced automated signal trading app for free.

Yes, that’s right. There is no monthly or annual fee that you need to pay in order to take advantage of the Binary Options Robot. You can benefit from binary options signal trading app using your binary options broker account.

You may wonder what this means. Well, all you have to do is register by filling in the necessary details in the registration form on the binary option robot website. The registration process is completely free. When all is set up, the trader can let the Binary Options Robot generate signals, according to the preferences on his dashboard, which the trader can accept with a single click.

Traders who want to place trades via automated signal trading apps should not look any further. This free binary option robot is definitely one of the best solutions on the market.

Binary Option Trading Robot

In recent times, a majority of trading firms have been marketing binary options for auto trading software aggressively. Some of the promises made by these firms seem too good to be true, and it has raised suspicion in the minds of beginner traders. These traders often question the overall legitimacy of these auto-traded robots.

So to answer this question, there is no doubt about the fact that binary option auto trading software, as a tool, is completely legit. The fact that these firms aggressively market these robots is primarily because auto trading is likely to generate more trading volume (hence more profit for the firms). At the same time, the benefits of these robots for the traders cannot be denied, and some of these benefits have been discussed in earlier sections of this article.

This is not to say, however, that these binary option auto trading robots are completely safe and secure, and that you will never be exposed to the danger of the scam. It is true that there have been few scams in the name of these robots. What needs to be understood is that this market is at risk of scams, just like most other markets, such as real estate.

Having the fundamental knowledge and the right approach is the key to avoiding these scams. Some of the scams like Crypto Genius are definitely a danger for beginners. For starters, do not fall for firms who lack any strong presence on social media, Google, and in the physical world. Similarly, always look for the track record of the firm to ascertain how long it has been in business, and the quality of service it has provided in the past.

Binary option auto trading can be very profitable, so claims by some firms regarding higher profitability may be true. However, claims that seem out of the world are likely to be red flags, and such firms may be avoided. Moreover, the quality and standard of the trading platform or auto trading software program is likely to tell a lot about the firm. Brokerage firms that are scams won’t invest in building or procuring a reliable and efficient trading platform.

The bottom line is that these trading robots are as legit as any other business. However, make sure to look for potential red flags in order to avoid any inconvenience at a later stage.